Earlier this year in May, the Federal Government announced their small business tax break incentive to boost the Australian economy. This tax break, essentially a tax write-off, allows for small businesses to invest in upgrading aspects of their venture such as machinery and furniture. Whilst there are limitations as to who is eligible for the tax break, you are eligible to receive this you meet all of the following criteria:

- If you have an active Australian Business Number (ABN).

- Your business earns less than $2 million per annum.

- Your purchased items cost less than $20,000.

- You purchase your items before the 30th of June, 2017.

What does this mean for small businesses?

Small businesses can now receive a tax deduction for nearly every asset that they need to operate. What brings companies such as ourselves into the equation is that this also includes heating and cooling units. You will now be able to upgrade or install a new climate control solution for your company, and it will be tax free. This will not only make your job more comfortable, but also provide your customers with an escape from the winter’s chill.

What does the winter have to do with this?

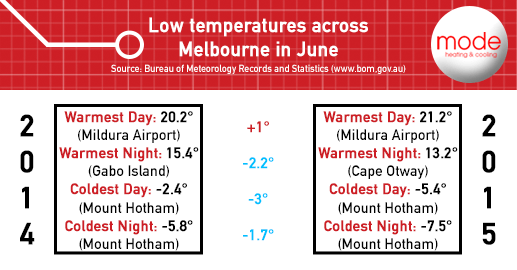

As you’ve probably heard recently, the south-east of Australia is experiencing a rare, winter blast. Temperatures in June dropped to their lowest recorded levels in over 65 years, with the first of June setting a new, record low. As the image below shows, temperatures this year are on average 1.4° lower than what they were at the same time last year.

At the time of writing this article, the average maximum temperature for July was currently at 13.1°. This is already down on the average for what was a record setting June, where the average was 14.4°. Comparing with this time last year, the averages are once again much lower this time around. As an example, the average in 2014 for June and July was 15.4° and 14.5° respectively.

A unique opportunity

With this cold weather set to continue, along with the tax concessions, there has never been a better time to invest in your own climate control solution. The conditions of the tax break work in particular favour for gas ducted heating and inverter ducted heating units. Because the tax break only focuses on individual assets, and not as a group, you can make huge savings on having these new systems fitted.

Furthermore, the incredible efficiency that new, ducted units now come with as standard also make sure that you will be saving money on your future power bills. A new wave of innovative technology has come the biggest names in the industry, such as Braemar heating units, Bonaire heating products, and Brivis heating solutions. These have made the units highly cost-effective, and they can repay back their value very quickly in energy savings, depending on use.

But it is the benefits of having your very own, brand new heating solution, which is perhaps the best incentive of all to invest. Not only will it make your working routine much more comfortable, but you will also be providing your customers or clients with relief from the cold weather. These little aspects are what makes up the bulk of a positive, first impression of your business.

Do you have any questions about installing and/or claiming tax back on a new climate control solution in your office, retail store, or factory? Why not leave us a comment below, and we will endeavour to get back to you as soon as possible.